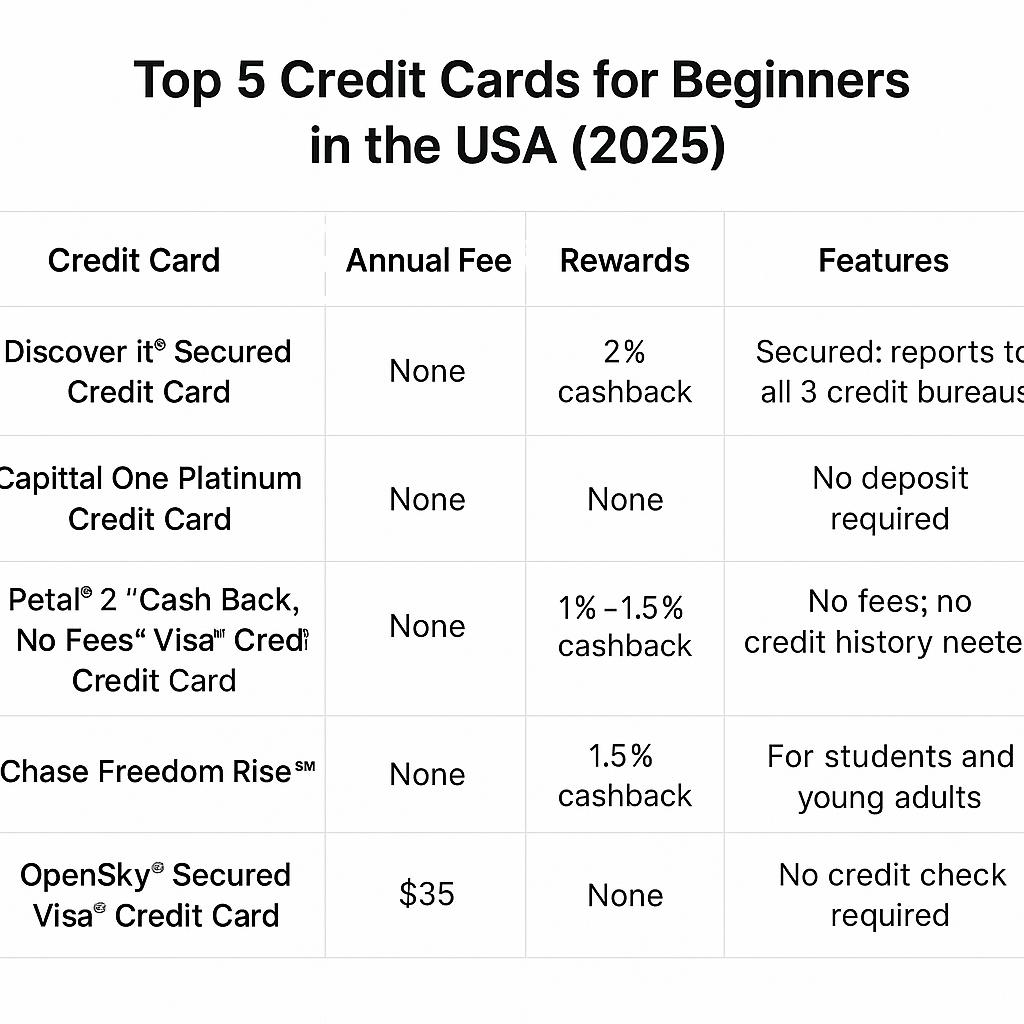

When picking your first credit card, consider:

• Annual fees – Many beginner cards have no fees

• APR (interest rate) – Lower is better if you carry a balance

• Rewards – Cashback or points can be helpful

• Credit requirements – Some cards are easier to get approved for than others

⸻

✅ Tips for First-Time Credit Card Users

• Always pay on time – Late payments hurt your credit score

• Don’t spend more than you can afford

• Keep your credit utilization low (below 30%)

• Check your credit score regularly – Use free tools like Credit Karma

⸻

📌 Conclusion

Getting a beginner-friendly credit card is one of the best ways to start building your credit in the USA. Whether you’re a student, a new worker, or just new to credit, the cards we listed above are all solid options for 2025. Be smart, pay on time, and watch your credit grow!